MINISTRY OF FINANCE AND ECONOMIC AFFAIRS VALIDATES THE DRAFT NEW PUBLIC FINANCE MANAGEMENT BILL

News

THE INTERNATIONAL MONETARY FUND GOVERNANCE DIAGNOSTICS MISSION’S TEAM PAID A COURTESY CALL TO THE MINISTER OF FINANCE

THE INTERNATIONAL MONETARY FUND GOVERNANCE DIAGNOSTICS MISSION’S TEAM PAID A COURTESY CALL TO THE MINISTER OF FINANCE

MAIDEN STEERING COMMITTEE MEETING OF THE TURN-AROUND ALLOCATION STRATEGY (TAA) CONDUCTED

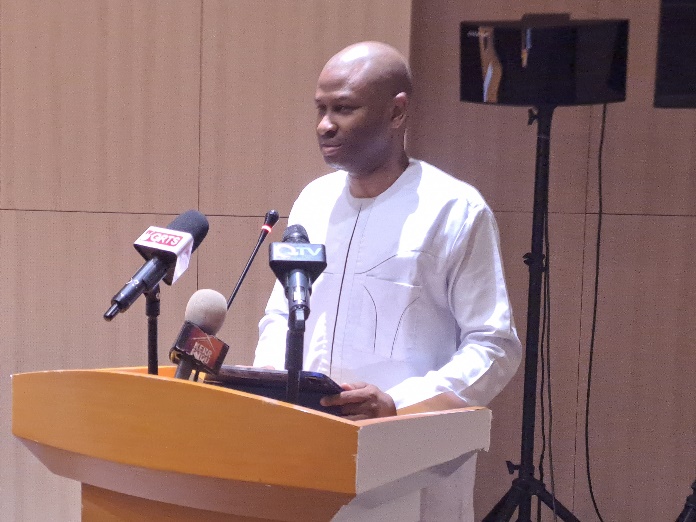

FINANCE MINISTER RESPONDED TO NAMS’ QUESTIONS ON THE 2023 BUDGET ESTIMATES OF REVENUE AND EXPENDITURE

FINANCE MINISTER RESPONDED TO NAMS’ QUESTIONS ON THE 2023 BUDGET ESTIMATES OF REVENUE AND EXPENDITURE

DIRECTOR GENERAL INTERNAL AUDIT APPOINTED AUDITOR GENERAL

PROCUREMENT DIRECTORATE CONVERGE TO TRAIN ITS STAFF

PROCUREMENT CLERKS CONVERGENCE/WORKSHOP

THE MINISTER OF FINANCE AND ECONOMIC AFFAIRS LAYS THE DRAFT BUDGET FOR THE FISCAL YEAR, 2023

THE ACCOUNTANT GENERAL’S DEPARTMENT BADE FAREWELL TO THEIR FORMER BOSS

PRESS RELEASE ON MCC GAMBIA’S SCORECARD

INVITATION TO BID FOR THE CONCESSION OF THE OPERATION AND MAINTENANCE OF the SIR DAWDA KAIRABA JAWARA INTERNATIONAL CONFERENCE CENTER (SDKJ- ICC), AND CONSTRUCTION OF ANCILLARY FACILITIES

THE MINISTRY OF FINANCE ORGANISED A TWO-DAY TRAINING ON PERFORMANCE CONTRACTS FOR STATE-OWNED ENTERPRISES

THE MINISTRY OF FINANCE ORGANISED A TWO-DAY TRAINING ON PERFORMANCE CONTRACTS FOR STATE-OWNED ENTERPRISES

MOFEA STAFF TRAINED ON ELECTRONIC RECORDS MANAGEMENT SYSTEM, INFORMATION, AND CONFIDENTIALITY

THE MINISTER OF FINANCE AND ECONOMIC AFFAIRS AT THE INSURESILIENCE GLOBAL PARTNERSHIP 7TH HIGH-LEVEL CONSULTATIVE GROUP (HLCG) MEETING

THE INSURESILIENCE GLOBAL PARTNERSHIP 7TH HIGH-LEVEL CONSULTATIVE GROUP (HLCG) MEETING

UNITED STATES EMBASSY COMPLIMENTS THE GAMBIA ON FISCAL TRANSPARENCY REPORT

NATIONAL ASSEMBLY APPROVED A 30% SALARY INCREMENT FOR CIVIL SERVANTS

The Ministry of Finance and Economic Affairs regrets to announce the death of Mr. Nuha Nyassi, which occurred today, 27th July 2022 in India while undergoing medical treatment

Citizens' participation in the formulation of the upcoming Recovery Focused NDP and Long Term Development Vision 2050.

Citizens' participation in the formulation of the upcoming Recovery Focused NDP and Long Term Development Vision 2050.

BADEA Visits MoFEA on Mission to Appraise UTG Project and Ongoing Operations

IMF Approves US$6.72 Million Disbursement For The Gambia Under The Extended Credit Facility

2021 Gambia’s Macroeconomic and Debt Portfolio

Hon. Seedy Keita replaces Hon. Mambury Njie as the New Minister of Finance and Economic Affairs

Public Enterprise meeting with the National Audit Office (NAO) and Gambia Ports Authority (GPA) on the Performance Audit on Cargo Handling

Public Enterprise holds a meeting with the National Audit Office (NAO) and Gambia Ports Authority (GPA) on the Performance Audit on Cargo Handling with the National Assembly Standing Committee.

The Gambia-USA Signed Development Objective Grant Agreement

ESTABLISHMENT OF A TAX ADVISORY COMMITTEE

Fifty-Fifth (55th) Annual Virtual Meeting Of The Governors Of The African Development Bank, 2020

AFDB VIRTUAL CONSTITUENCY ANNUAL GOVERNORS MEETING,2020

MOFEA-BANKERS’ ASSOCIATION MEETING

Commonwealth Meridian to support Sovereign Debt Management in the Gambia

Commonwealth Secretariat Fosters Collaboration between Governments of The Gambia and Ghana on Good Governance and Enterprise Risk Management

Commonwealth Secretariat Fosters Collaboration between Governments of The Gambia and Ghana on Good Governance and Enterprise Risk Management

Government of The Gambia Partners with Commonwealth Secretariat in Establishing Enterprise Risk Management (ERM)

Government of The Gambia Partners with Commonwealth Secretariat in Establishing Enterprise Risk Management (ERM)

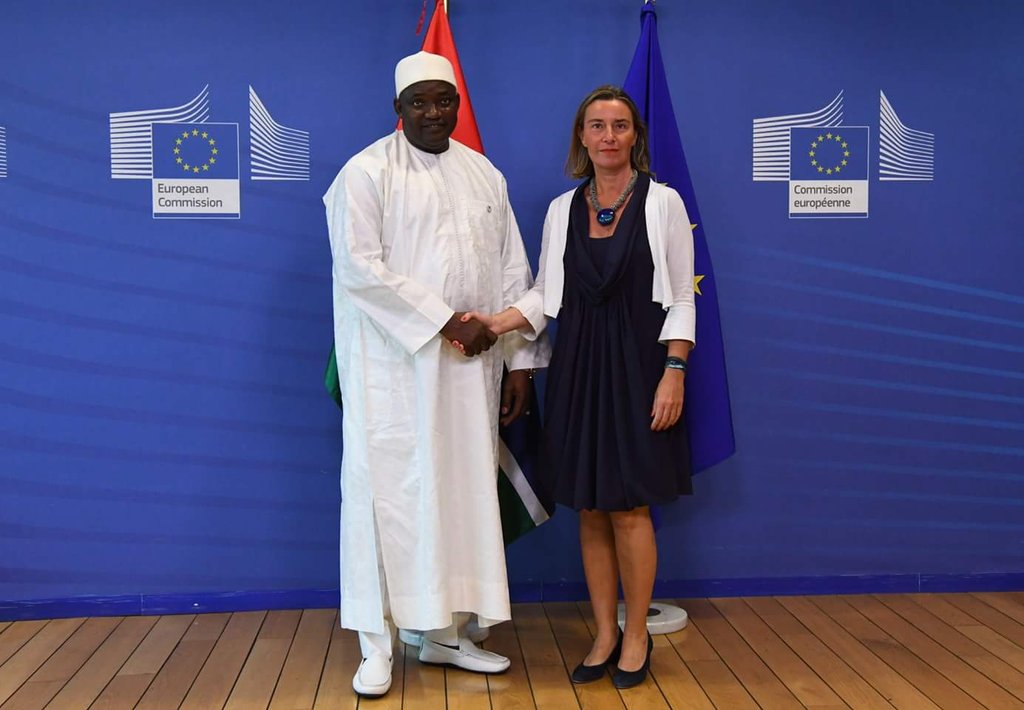

The International Conference for The Gambia takes place on 22 May in Brussels at the European Commission (Berlaymont).

Country’s Generated Income Exceeded Targeted Value’Finance Minister

The minister of Finance and Economic Affairs, Amadou Sanneh, has revealed that the government of The Gambia has secured a three-year project of $86.6 million for the reconstruction of the Laminkoto-Passamass road.

The EU ambassador to The Gambia has argued that The Gambia signing and ratifying the Economic Partnership Agreement (EPA) deal simply guarantees duty free, quota free, access to the EU market for all Gambian products.

The governor of the Central Bank of The Gambia has announced that the country's economy is projected to grow from 3% in 2017 up to 5% in the medium term.

The governor of the Central Bank of The Gambia, Bakary Jammeh, has said that the country will begin replacing currencies bearing former leader’s face with ones called family notes.

The Government's Accountant General, Momodou Lamin Bah, Trust Bank Managing Director and the Managing Director of Guaranty Trust Bank Ayodeyel Bolaji, yesterday reappeared at the 'Janneh' Commission to explain financial matters surrounding the former regime.

The vice president of the republic of The Gambia Fatoumatta Jallow-Tambajang has spoken extensively about the importance and the role of customs in revenue mobilization and said customs are key drivers of economy.

The Gambia has shown interest in the presidential seat of the regional bloc ECOWAS, a statement from the Presidency stated on Tuesday.